This dossier is about inequality, or inequalities, between the North and South, between the rich and poor, and between the classes that labour and those that profit. This inequality is also produced by various forces and vectors of global capitalism that divide, exclude, and polarise the world. The collages in this dossier give expression to this inequality and to the extreme asymmetry that is iconic of our times. Contrast is key in these collages: contrast between colours, compositional balance, and content, where everyday activities – eating breakfast, commuting to work, sleeping – become situations where inequality is intimately lived and felt.

Source of images: Wikimedia Commons, British Library, Fotos Públicas, and the documentary Las Fuerzas de la Desigualdad (‘Forces of Inequality’) by Tricontinental: Institute for Social Research, Comuna Audiovisual, 2021.

Introduction

What are the most characteristic elements of our moment in history? This question has multiple answers. Twenty-first century capitalism reflects an unprecedented pace: rapid international transitions, the shaping of an indisputably multipolar world, significant techno-productive innovations, and new developments in information technology and telecommunications that have changed the ways in which we interact, among many other issues.

At times, this context of rapid change seems to obscure one of the most obvious and at the same time outrageous issues of our contemporary existence: the abysmal difference between the living standards of the rich and the poor the world over. Evidently, we are living in an era in which global capitalism has managed to sweep under the rug some of the most detrimental results of the process of social exclusion produced by the emergence of neoliberalism and its successive crises. Discourses that time and again reinforce the hegemonic view of concentrated global capital lead us to normalise the production and reproduction of inequality in contemporary societies, as if they were the result of individual decisions by people who do not try hard enough or of bad governments. Even when the World Bank and the various think tanks of neoliberal globalisation try to present themselves ‘with a human face’, they continue to reproduce these analyses, according to which the solution to reduce the extreme inequality in our world is to grant the same opportunities to all.

However, the data does not seem to support this simplistic reading. The richest 1% of the world population today holds more than 70% of global wealth. This means that, as of January 2022, the world’s 10 richest men ‘own more than the bottom 3.1 billion people’, according to an OXFAM report.1 The world’s richest, a kind of plutocracy according to some analysts, have incomes that are unthinkable for 80% of the world population. Among the 2,668 billionaires, many of the top earners are familiar names: Elon Musk (the founder and CEO of Tesla, worth $219 billion), Jeff Bezos (the former CEO of Amazon, with a fortune of $171 billion), Bernard Arnault (the CEO of LVMH, with $158 billion to his name), Bill Gates (the former CEO of Microsoft Corp, worth $129 billion), and Warren Buffett (the CEO of Berkshire Hathaway, worth $118 billion).2

How can we understand inequality other than this approach of blaming the poor for being poor? It is worth keeping in mind that the enormous income and wealth gaps we are experiencing do not only have national origins, but that the reason for these gaps lies largely in the logic of polarisation brought about by capitalism as a world system. Therefore, we must differentiate between the global and the national scales to understand why these processes constantly produce an abyss between rich and poor in contemporary capitalism.

That is why Tricontinental: Institute for Social Research’s dossier no. 57 is dedicated to discussing the geopolitics of inequality, the conditions of exclusion that the North imposes on the South and that attempt, by all means, to present the idea that this inequality is temporary and that we must make a greater effort to reduce the gaps.

The Deep Asymmetry between the North and South

Contemporary capitalist trends, especially since 2008, have enormously deepened the dynamics that produce inequality and that have been present since the very origin of capitalism. After a period of relative improvement in working-class incomes, the definitive rupture of the Fordist regimes in the North and of the national-popular systems in the South significantly widened the gap in living conditions between the two extremes. By definition, under this capitalist system, the opulence of the few is the product of the hunger and misery of the millions.

The accelerated dynamics of Western financial power; the flexibilisation of forms of contracting, work processes, and working hours; and the relocation of the production of goods and services, among other issues, have been the main driving forces of the increasingly unequal global order since the 1973 oil crisis. Ultimately, as the geographer David Harvey points out, neoliberalism is a project of the ruling class to restore its power and profits on a global scale.3

In the twenty-first century, three global financial crises have led to new processes of income and wealth redistribution in favour of the wealthy minority. The aftermath of the 2008 crisis – the moment when the real estate bubble burst in the United States – was nothing more than an intense process of the concentration of capital and income, or, in other words, of the social power of big business. The growing prominence of the leading global financial companies, Industry 4.0, and the gig economy simultaneously created new means of capital accumulation. The recovery, therefore, created a new bubble, this time based on high-tech companies, especially digital platforms such as the monopoly known as GAMA (Google, Apple, Meta, and Amazon). This combination of financial capital and platform capitalism driven by the Global North has only deepened instability and crisis. The celebratory discourse of technology and productivity gains that the World Bank has been advancing since 2016 – which would supposedly produce a leap forward in well-being in the West – has proven to be false time and again. This process of technological incorporation only resulted in the acceleration of the monopolisation and the appropriation of income by the financial and high-tech conglomerates. The flip side was not technological unemployment, but billions of impoverished working people, even if they had a salaried job.4

CoronaShock, which we at Tricontinental: Institute for Social Research have previously addressed in its different dimensions, resulted in a doubling of the wealth of the richest 1% of the world’s population.5 From 2020–2021, a new billionaire appeared every 26 hours, while the incomes of 99% of the population declined. Meanwhile, of the total wealth generated in the world in 2022, 76% is pocketed by the richest 10% of the global population, while the poorest 50% receives only 2%.6

The geopolitical and geoeconomic dimensions of this data are crucial, as this unequal distribution differs substantially across countries and regions. If we look at inequality in different regions of the world, we can see that the Global South has higher income and wealth inequality rates than the Global North. In terms of incomes, we find that in North America and Western Europe, the richest 1% of the population received around 35% of the wealth in 2020, while the poorest 50% received 19% of total income. In contrast, we find that in Latin America, the Middle East and North Africa, South Asia, and sub-Saharan Africa, the poorest 50% of the population receives between 9% and 12% of national income, while the richest 10% receives between 45% and 58%.7

These indicators, compiled by international organisations, clearly show the different levels of inequality in each country and region. A number of authors argue that the only alternative to our current reality – one plagued by inequality and poverty – is a capitalist world with a human face. They have suggested that North-South inequality is gradually disappearing, as if to indicate that we are on the path towards resolving this vast inequality. Burbach and Robinson highlight a significant reduction in the difference in incomes between different countries since the fall of the Berlin Wall.8 On the other hand, Hoogvelt claims that the core-periphery relationship is nothing more than geographical, which downplays the organic link between the processes of income seizure in the North and South.9 These authors base their analysis on the idea that the North-South divide refers to the dynamic between the industrialised North versus the non-industrialised South. With the industrial growth of several regions, especially Asia, and its implications in terms of accelerating Gross Domestic Product (GDP) growth, their interpretation is that income gaps are narrowing.

These analyses seem to respond more to a political/ideological premise than to the evidence offered by the modern capitalist world. As Arrighi, Silver, and Brewer demonstrate, ‘the North-South divide remains a fundamental dimension of contemporary global dynamics’.10 It is important to highlight this point, as most analyses of inequality start from a national scale and omit the uneven nature of global power over oppressed regions and peoples.11

Gaps in the Gross Industrial Production of different regions of the world compared to the countries of the North have narrowed. In contrast, inequality in per capita income of different peripheral regions as compared to the Global North has remained very high. A paradigmatic case is that of the region of North Africa and the Middle East, which represents 185% of the manufacturing output of the North but only accounts for 15% of the per capita income of rich countries. Of course, as mentioned, South Asia and sub-Saharan Africa have high shares of manufacturing output alongside extreme inequality as compared to the rich North (their per capita income is only 2.8% and 3.4% of the North’s, respectively).12

In short, while the periphery is the world’s factory, services, finance, and the manufacturing of complex products remain in the core. The Global South produces 26% more manufactured goods than the North but accounts for 80% less income per capita.13 The assertion that inequality is due to the lack of development of productive forces in the South thus becomes nonsensical. This is an important point. Following Rostow’s analysis, all liberal/neoliberal approaches to development expect that a sustained process of industrialisation in the periphery will result in these countries reaching the same standard of living as the core.14 These approaches seem to ignore the fact that, while manufacturing has shifted to the periphery, where the output share has accelerated relative to the North since 1960, this has not substantially altered income distribution patterns.

In other words, even though the industrial divide that existed in the twentieth century between core and peripheral countries has almost completely disappeared, the centres of global capitalism still control the productive process and the monetary capital that allow the initiation of cycles of productive accumulation. Herein lies the key to understanding that the asymmetric power of the Global North over the Global South is expressed through a new logic of subordination and peripheralisation, one that is not exclusively a question of the unequal exchange of manufactured goods versus primary goods. To the contrary, it is the control over the very process of offshoring and the asymmetrical integration of different regions into global production networks (GPNs) that gives rise to substantial distributive differences, even in the context of accelerated industrialisation processes in the periphery.

It is worth asking whether the difference in per capita income between countries is a good indicator of inequality. For example, from Milanovic’s point of view, this comparison indicates lower levels of inequality than actually exist. He therefore proposes that we compare individuals’ incomes. For example, if we include people across the world in a comparable unit of measurement, we find that for the years 1970–2010, the Gini coefficients of the Nordic countries were below 30%, while countries such as Brazil reached an inequality rate of close to 60%.15

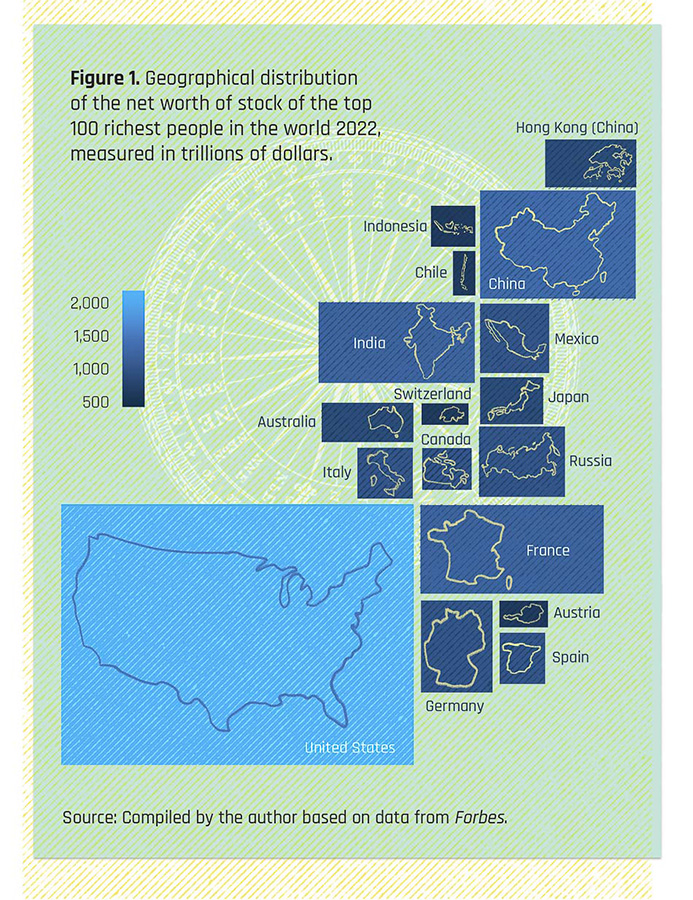

In 2019, the individual income inequality rate of the Global South as a whole was 33% higher than that of the North.16 This is because the process of neoliberal globalisation has resulted in an extreme widening of the income gap between the world’s super-rich and the world’s poorest, with a middle-income sector that has improved its position. The more than 60% increase in the incomes of the richest 1% between 1988 and 2008 was accompanied by stagnant growth in the incomes of the poorest sectors.17 If we look at who makes up this small group of the super-rich, most of them are in the Global North, while some are citizens of the major emerging countries of the South, mainly China, India, South Africa, Russia, and even some Latin American countries.

The ranking published by Forbes business magazine, summarised in figure 1, illustrates this distribution of global income. In concrete numbers, we can see that, as of 2022, 37 of the 100 richest people in the world are based in the United States, the leading representative of the geopolitics of inequality. Between them, they account for $2.3 trillion, i.e., more than 51% of the wealth of the world’s 100 richest people.

Some important problems arise here that are not usually taken into account by this kind of analysis of inequality between individuals. Looking exclusively at individual income inequality rates across populations only obscures a major problem: countries with low individual income inequality may have real incomes that are completely unrepresentative of the current levels of development of the productive forces of labour. For example, Algeria has a Gini index similar to those of Norway or Finland. However, the average daily income of a household in Norway is $19,000 per year, while that of a household in Algeria is $2,600 per year. Another significant example is the difference between the United States and the Democratic Republic of the Congo. The two countries have a Gini coefficient of 42, but the difference in average annual income is stark: $19,300 in the United States and a mere $892 in the Democratic Republic of the Congo.18

These examples clearly reveal the gross injustice in the varying purchasing power of different countries, even though the overall inequality indices are similar. One interpretation commonly upheld by international organisations is that middle-income countries will be more unequal than rich countries and poor countries. The problem with this interpretation is that it downplays the organic link between the North and the South, between development and underdevelopment, between the core and the periphery, and, finally, between sovereignty and dependence. As we shall see, the productive and distributive capacities of the North are built on the subordination of the South. While individuals at the bottom of the income ladder in the North have access to a basket of consumer goods that is greater than the poverty-line basket, in many countries of the South, poverty and destitution are commonplace for large percentages of the population.

Class Inequality in the Global North and South

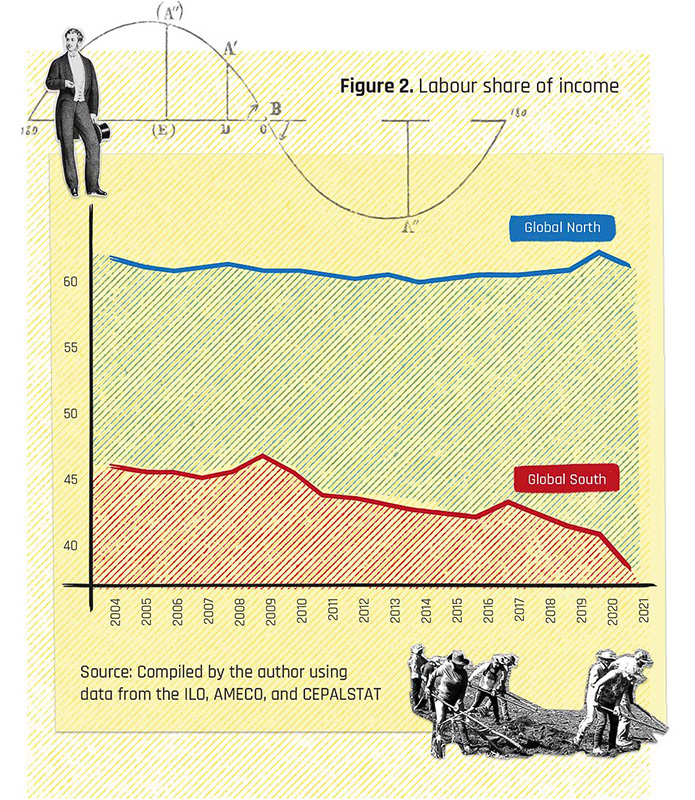

How do individuals in different regions of the world earn their incomes? That is, what are the social relations that give rise to sustained income inequality between rich and poor people? Only by revisiting the class system that lies behind inequality can we explain its origins. We believe that the root cause of inequality at national and global levels must firstly be traced to increases in inequality between the different classes. Wage earners have received a dwindling share of the gross product generated on a global scale since the 1970s. This decline has continued in the twenty-first century, from 54% of the gross world product in 2004 to 51% in 2021. This downwards trend in the incomes of working people during the twenty-first century was only temporarily reversed in the context of the 2008–2009 global crisis, as the fall in working-class wages is always slower during recessions.19

The global decline in labour share in the twenty-first century is led by the core countries, in particular those in Western Europe and the United States, where the wage share of national income has fallen by more than 2 and 3 percentage points respectively since 2004. However, as we can see in figure 2, the gaps between countries are so wide that even though Latin America (until 2014) and China were able to increase their wage shares for some years, they by no means match the levels of the North. Other regions in the periphery, such as Southeast Asia, have even seen their already very low wage share of national income fall. The countries in which workers have a national income share of more than 50% are the United States, Canada, and those of Western Europe, with the exception of three Latin American countries: Argentina, Chile, and Brazil.20

This has led some authors, such as Milanovic, to argue that inequality in the twenty-first century is better explained by location rather than class.21

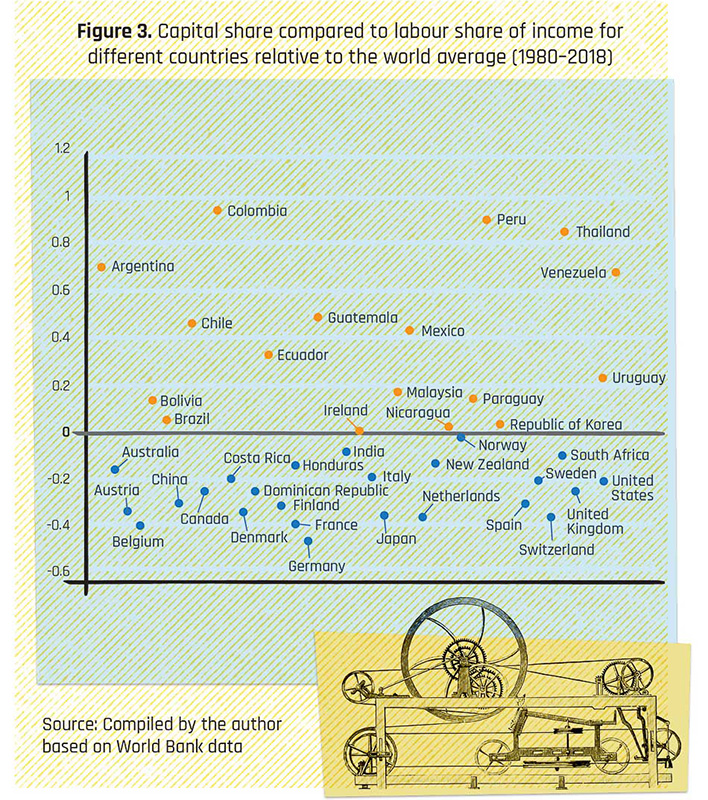

What happens if we view inequality as each country’s difference in income relative to the global average? In the world’s 163 countries, only 32% of households have incomes above the global average. Of this total, only a few countries in the periphery have above average incomes, while 100% of the core countries are above the average. Moreover, we see that the difference between incomes in the core countries and the world average is very high; cases where incomes are more than 200% higher stand out, such as Luxembourg, Norway, the United States, and Canada.22 At the same time, it is precisely the countries of the South, the world’s periphery, that have the highest levels of class inequality, as we can see from the labour share of wage earners (figure 3). Furthermore, if we take the income of capitalists as compared to the income of wage earners, we again find that most of the world’s periphery has above average class inequality, while all the countries of the core have lower levels of labour exploitation relative to the average.

In addition, and perhaps more importantly, there is a direct relationship between class inequality and location. Historical patterns of dependency have been exacerbated by highly interdependent, globalised, and financialised contemporary capitalism, with high levels of offshore manufacturing. On the one hand, the North has been strengthened as the geographical space that controls global wealth accumulation processes and, in tandem, societies in the periphery have been regressively restructured. Therefore, we see that with the emergence of neoliberalism and successive contemporary crises, there are at least four processes which have strengthened the power of the ruling class on a global scale: the transnationalisation of capital and the offshoring of manufacturing; financialisation; the hyper-concentration of capital; and the revolution in transport, telecommunications, and information technology. These associated processes were underpinned by the resurgence of ruling class power and income, only to be countered by the re-emergence of other poles of global power with outlooks differing from Western development dynamics.23

The Challenge of Swimming against the Tide

Present-day capitalism tends to multiply the inequalities between the North and the South, between capital and labour, and between the rich and the poor. One of the key determinants of the impoverishment of the vast majority of the world’s population is the deepening structural dependence of the countries of the Global South. An unprecedented concentration of wealth, which has as its backdrop a unique concentration of power, is nothing more than an indicator of a structural dynamic of peripheralisation of the South vis-à-vis the North through its subordinate inclusion in global production networks. These networks have resulted in a new international division of labour, which reserves the direction and control of production processes for the North and decentralises production to other regions to take advantage of lower costs and access to natural resources.

Thus, the geopolitics of inequality reinforce the dynamics of differential income distribution between labour and capital, between different groups of workers, between individuals, and between those who obtain income from the ownership of different assets (land, technology, etc.) and those who do not.

Faced with these trends, what alternatives are available to the people of the South? Even if the battle appears to be set in terms of David versus Goliath, upon considering some key points, we can see that another pathway is possible through the adoption of several policies:

1)The partial disconnection of global chains

Global value chains promised to enable the development of modern poles that would boost the economies of the entire periphery. However, they have had the exact opposite result to that expected: the inequalities between internationalised sectors and other sectors have grown. These widening inequality gaps must be combated through state mediation. This means greater participation in South-South trade networks based on complementarity as opposed to participation in global chains. This partial disconnection from global chains implies a distancing from the North’s control of global production processes and the resulting exploitation of workers in the South to satisfy the needs of the Global North.

2) The appropriation of revenue by the state

One quintessential form of class inequality in the South is the oligarchic appropriation of land rents, mining and technological revenues, and other forms of revenue. The state’s concrete intervention in appropriating revenue is key to reducing the ruling class’s income growth. This growth has nothing to do with increased investment; rather, it almost exclusively derives from the ownership of a fixed factor of production and the possibility of patenting it for exclusive use.

3) The taxation of speculative capital

The celebrated mobility of global capital has only increased speculative income in the countries of the South, leading to attacks on national currencies, financialisation processes, and constant capital flight. Imposing high taxes on speculative capital and mixed private-public ownership can significantly improve the control of national production processes and cushion crises which usually result in massive capital outflow, deepening unemployment and poverty.

4) The nationalisation of strategic goods and services

A more equal national and regional development process requires further nationalisation of strategic assets, which is key to reducing the degree of foreign ownership in the economies of the South. To a large extent, rolling back the privatisation measures of the Washington Consensus can allow for greater national sovereignty, as can strategic guidelines on how to use the resources that belong to the people to benefit the majority.

5) The taxation of corporate and individual windfall profits

Even within the capitalist framework, a major issue is to differentiate between normal or average profit sectors and those producing windfall profits. It is clear from what we have discussed in this dossier that the most dynamic sectors of the global economy are those linked to finance and platforms. In the countries of the periphery, transnationalised sectors or those with strong market penetration achieve the highest levels of revenue. These increases in profits generally do not result in higher levels of employment, better wages, and so on. Therefore, it is imperative to design taxes to be levied on those sectors that are hyper-profitable.

Of course, these points are only partial aspects of the debate. We must study them in greater depth in order to coordinate our national struggles with global perspectives and with demands on states to abandon austerity policies, which only widen the gap between the rich and poor and between the North and South. These gaps are already intolerable from a humane point of view.

Endnotes

1 OXFAM, Inequality Kills, 10.

2 Dolan and Peterson-Withorn, eds., ‘World’s Billionaires List’.

3 Harvey, Espacios del capital.

4 Benanav, La automatización y el futuro del trabajo.

5 Tricontinental, CoronaShock.

6 OXFAM, Inequality Kills; Chancel et al., World Inequality Report 2022.

7 Our own calculations based on data from Chancel et al., World Inequality Report 2022.

8 Burbach and Robinson, ‘The Fin de Siecle Debate’, 10–39.

9 Hoogvelt, ‘The History of Capitalist Expansion’.

10 Arrighi et al., ‘Industrial Convergence, Globalisation, and the Persistence of the North-South Divide’, 4.

11 Amin, ‘La economía política del siglo XX’.

12 Our own calculations based on data from the World Bank; UC (Davis) and Groningen Growth Development Centre, Penn World Table.

13 Data from the World Bank; UC (Davis) and Groningen Growth Development Centre, Penn World Table.

14 Rostow, ‘The United States in the World Arena’, 7.

15 Milanovic, ‘Global Income Inequality in Numbers’, 198–208.

16 Our own calculations based on data from Milanovic, ‘Global Inequalities in Numbers’, 2013.

17 Milanovic, ‘Global Income Inequality in Numbers’, 202.

18 Our own calculations based on data from ILOSTAT.

19 Our own calculations based on data from ILO, AMECO, and CEPALSTAT.

20 Our own calculations based on data from López and Noguera, ‘Crecimiento, distribución, y condiciones dependientes’.

21 Milanovic, ‘Global Income Inequality in Numbers’, 198–208.

22 Our own calculations based on World Bank data.

23 Arrighi, ‘La economía social y política de la turbulencia global’.

Bibliography

Amin, Samir. ‘La economía política del siglo XX’ [The Political Economy of the Twentieth Century]. Revista Globalización, June 2000.

Arrighi, Giovanni. ‘La economía social y política de la turbulencia global’ [The Social and Political Economy of Global Turbulence]. Revista Globalización, July 2007.

Arrighi, Giovanni, Beverly J. Silver, and Ben D. Brewer. ‘Industrial Convergence, Globalization, and the Persistence of the North-South Divide’. Studies in Comparative International Development 38, no. 1 (2003): 3–31.

Benanav, Aaron. La automatización y el futuro del trabajo [Automation and the Future of Work]. Madrid: Traficantes de Sueños, 2021.

Burbach, Roger, and William I. Robinson. ‘The Fin de Siecle Debate: Globalization as Epochal Shift’. Science & Society 63, no. 1 (1999): 10–39.

Chancel, Lucas, Thomas Piketty, Emmanuel Saez, and Gabriel Zucman. World Inequality Report 2022. World Inequality Lab, 2022.

Cope, Zak. The Wealth of (Some) Nations: Imperialism and the Mechanics of Value Transfer. London: Pluto Press, 2019.

Dolan, Kerry A. and Chase Peterson-Withorn, eds., ‘World’s Billionaires List: The Richest in 2022’. Forbes, 11 March 2022. Accessed 1 October 2022. https://www.forbes.com/billionaires.

Economic Commission for Latin America. ‘CEPALSTAT: Statistical Databases and Publications’. https://statistics.cepal.org/portal/cepalstat/index.html?lang=en.

Directorate General for Economic and Financial Affairs, European Commission. ‘AMECO Database’. https://economy-finance.ec.europa.eu/economic-research-and-databases/economic-databases/ameco-database_en.

Harvey, David. Espacios del capital. Hacia una geografía crítica [Spaces of Capital: Towards a Critical Geography]. Madrid: Akal, 2007.

Hoogvelt, Ankie. ‘The History of Capitalist Expansion’. In Globalisation and the Postcolonial World. London: Palgrave, 1997.

International Labour Organization. ‘ILOSTAT’. https://ilostat.ilo.org/.

López, Emiliano and Deborah Noguera. ‘Crecimiento, distribución y condiciones dependientes: un análisis comparativo de los regímenes de crecimiento entre economías centrales y periféricas’ [Growth, Distribution, and Dependent Conditions: A Comparative Analysis of Growth Regimes between Central and Peripheral Economies]. El Trimestre Economico 87, no. 346 (April–June 2020). https://www.eltrimestreeconomico.com.mx/index.php/te/article/view/936.

Marini, Ruy Mauro. ‘Procesos y tendencias de la globalización capitalista’ [Capitalist Globalisation Processes and Trends]. In La teoría social latinoamericana. T. IV: Cuestiones contemporáneas, edited by Ruy Mauro Marini and Márgara Millán. Mexico City: UNAM, 1997.

Milanovic, Branko. ‘Global Income Inequality in Numbers: In History and Now’. Global Policy 4, no. 2 (2013): 198–208.

Milanovic, Branko. Desigualdad mundial. Un nuevo enfoque para la era de la globalización [Global Inequality: A New Approach for the Age of Globalisation]. Madrid: Fondo de Cultura Económica, 2017.

OXFAM. Inequality Kills: The Unparalleled Action Needed to Combat Unprecedented Inequality in the Wake of COVID-19. 17 January 2022. https://oxfamilibrary.openrepository.com/bitstream/handle/10546/621341/bp-inequality-kills-170122-en.pdf.

Rostow, Walt W. ‘The United States in the World Arena’. Naval War College Review 13, no. 6 (1960): 7.

Tricontinental: Institute for Social Research. CoronaShock: A Virus and the World. Dossier no. 28, May 2020. https://thetricontinental.org/dossier-28-coronavirus/.

University of California (Davis) and Groningen Growth Development Centre of the University of Groningen. Penn World Table (1950–2019). https://febpwt.webhosting.rug.nl/.

World Bank. ‘World Bank Open Data’. https://data.worldbank.org/.

Original Contents by The Tricontinental